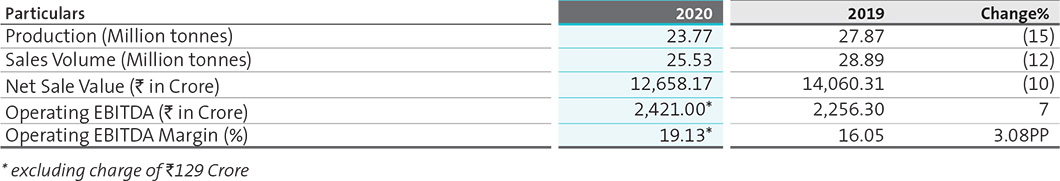

SALES VOLUME

In 2020, the Company’s cement sales de-grew by 11.6% from 28.89 Million tonnes in 2019 to 25.53 Million tonnes. Overall, the industry witnessed de-growth of ~10-12% due to the COVID-19 pandemic. However, in the second half of 2020, the industry showed signs of early recovery. In the retail segment, individual home builders and ground plus three storey (G+3) buildings continue to remain the Company’s largest customer segment in terms of volume and profitability. With growing urbanisation and rural empowerment, the demand from these sectors is expected to accelerate.

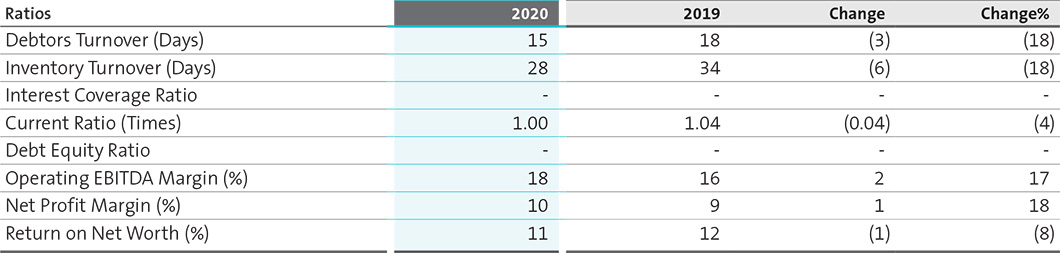

DETAILS OF SIGNIFICANT CHANGES IN KEY FINANCIAL RATIOS

Key financial ratios of the Company showing its financial performance are as under