Material Topics

- Economic Performance

- Procurement Practices

- Climate and Energy

- Indirect Economic Impacts

Stakeholders Impacted

Investors and Shareholders

Employees

Channel Partners

Suppliers

Community and NGOs

Focus Areas

Developments and Key Initiatives |

Key Performance Indicators |

|

|---|---|---|

Growth |

Reported strong revenue growth |

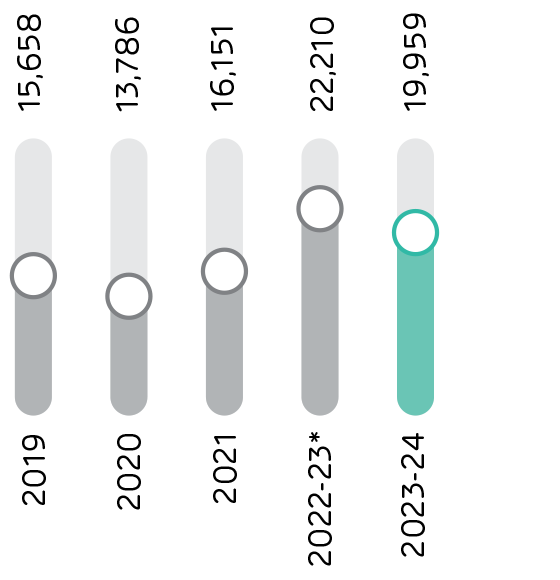

` 19,959 crore

Revenue from operations |

Margin Management and Efficiency |

Cost optimisation achieved through focused initiatives for energy, logistics and others Enhanced share of premium products |

17.4 %

EBITDA margin |

Financial

|

Strong capital profile with robust cash and bank balance Healthy asset base |

` 4,667 crore

Cash and cash equivalent ` 23,386 crore

Total assets |

Shareholder

|

Shareholder value creation through dividend issue |

` 7.5

Proposed dividend per share in FY 2023-24 ` 174 crore

Dividend payout during the year 7 %

Dividend payout ratio |

Overview

During the year, ACC demonstrated resilience with robust financial performance attributed to market expansion, operational excellence, cost efficiency and strategic synergies. Focused market expansion and consumer connect efforts drove robust volume growth. The Company prioritises cost optimisation, leveraging group synergies and implementing business excellence initiatives to reduce operating costs, improve blended cement sales, and expand EBITDA margin. Efforts to enhance working capital and treasury income have yielded positive results.

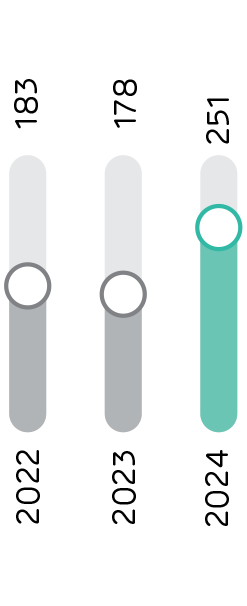

Growth Trajectory

During the year, ACC announced the initiation of commercial production of clinker and cement at its Ametha Cement Plant in Madhya Pradesh. This not only boosts production capacity but also strengthens its presence in the market, echoing the Company’s focus on innovation, quality, and sustainable growth. The Company also strengthened its market leadership with the acquisition of Asian Concretes and Cements Pvt Ltd at an Enterprise Value of ` 775 crore.

Revenue from Operations

(` crore)

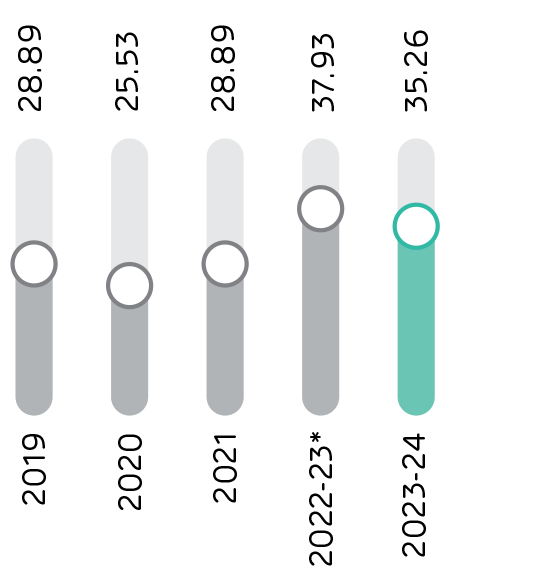

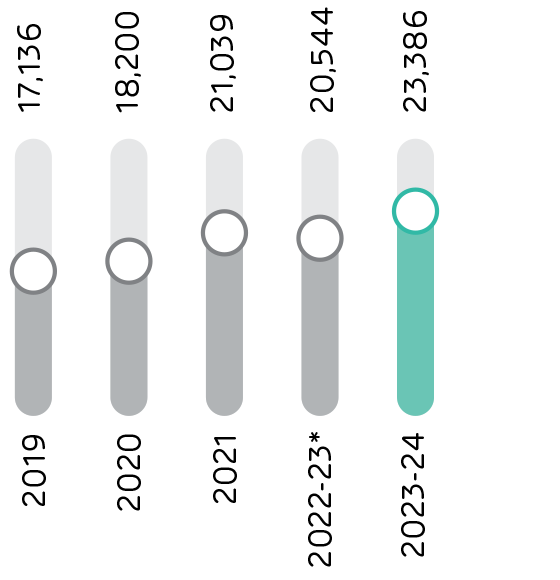

Cement Sales Volume

(MMT)

*Note: The Company had changed its financial year end from December 31 to March 31 in FY 2022-23. Therefore, the figure for FY 2022-23 is for 15 months and not comparable with the figures for the 12 months year ended March 31, 2024.

Margins and Efficiency

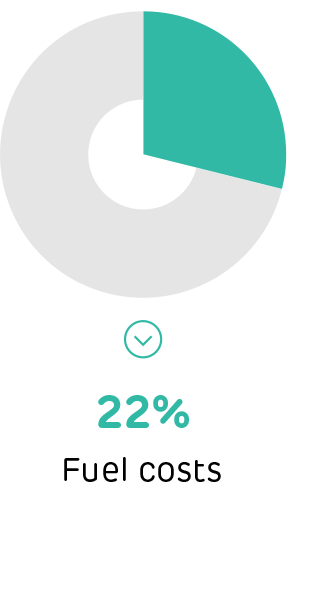

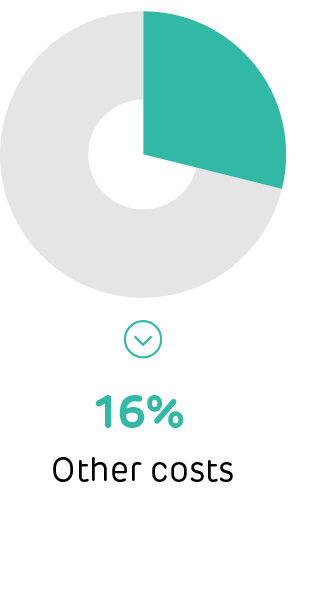

ACC maintains a continuous focus on cost rationalisation, resulting in an EBITDA of ` 3,555 crore and an EBITDA margin of 17.4% for the reporting period. Despite facing inflationary pressures, the Company effectively managed to control the growth in total operating costs. This was achieved through increased utilisation of energy from waste heat recovery systems, substitution of imported coal with domestic coal, and implementation of various logistics improvement and cost optimisation initiatives.

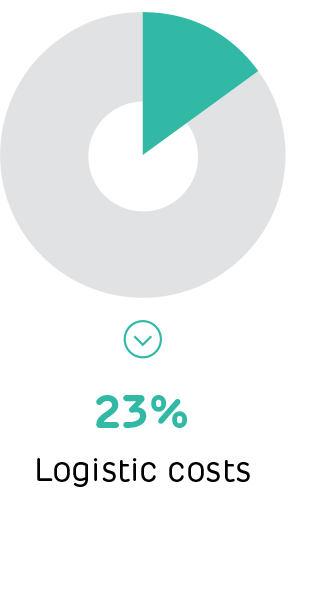

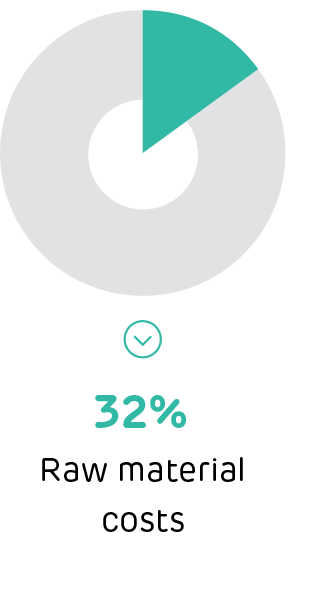

Cost Break-up Percentage of Total Cost

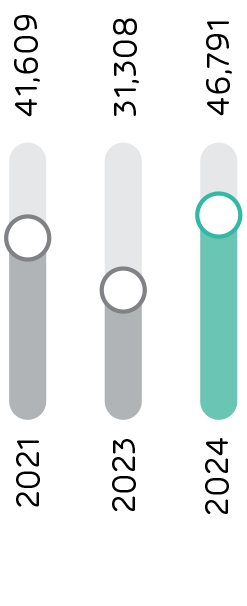

Growing Asset Base

(` crore)

Earnings

The Company's pre-tax profit reached ` 2,759 crore, showcasing a pre-tax profit margin of 14%. The year’s net profit amounted to ` 2,337 crore, with a net profit margin of 12%.

Assets

ACC’s total assets amounted to ` 23,386 crore, with current assets representing 41.59% of the total assets during the review period.

The Company’s funding profile improved in the reporting year, supported by robust profit generation that enhanced its net worth. The Company continues to remain debt-free in the long term.

Cash Flow

The Company’s cash flow positioning improved over the years due to heightened activity levels and efficient working capital management, driven by a widespread enhancement in operational performance that increased its operating cash flow. Net cash from operating activities turned positive in FY 2023-24. In FY 2022-23, cash outflow was ` 1,235 crore which turned into net cash inflow of ` 2,995 crore in FY 2023-24.

Credit Rating

CRISIL Ratings has reaffirmed the highest category Long Term Credit Rating of AAA/Stable and Short Term Credit Rating of A1+ for the bank loan facilities. This indicates the Company’s sound financial health, ability to meet financial obligations and robust risk profile.

Long term rating:

CRISIL AAA/Stable outlook

Short term rating:

CRISIL A1+

Capacity Expansion Projects

The Company aims for a capacity of 140 MTPA by FY 2027-28, innovation and cost efficiency are its priorities. The Company leverages operating cash inflows to strengthen its balance sheet, ensuring prudent capital allocation for cement capacity expansion and clean energy projects. Sustainable growth for stakeholders is its goal, funded through operational cash flows and internal accruals, maintaining financial discipline throughout its expansion endeavours.

The Company successfully completed the acquisition of Asian Concretes and Cements Pvt Ltd with 2.8 MTPA capacity. It successfully commissioned the Ametha integrated unit, boosting annual clinker capacity by 3.3 MTPA. Capex projects focus on increasing cement production through new plant establishment, existing plant debottlenecking, and efficiency enhancement, incorporating waste heat recovery, alternative fuel utilisation, and green power operation.

Investor Relations

The Company’s Investor Relations function ensures proactive communication with stakeholders, providing updates on significant developments, current affairs, and future prospects. This is achieved through various investor interaction platforms, including quarterly investor calls, participation in investor meetings and conferences, investor presentations, the integrated annual report, and the annual general meeting.

Capacity Details (MTPA)

Existing capacity 38.55

Projects under execution 4.00

Total Capacity by FY2026 42.55

Market Capitalisation

ACC (Standalone)

(` crore)

BSE 100 Ranking Company

(` lakh crore)

ACC has transitioned from a traditional finance mindset to a business finance model, emphasising long-term value creation and genuine business partnerships. The Company is dedicated to generating superior stakeholder value by effectively managing financial capital. Through a unique and disciplined financial management approach, optimal resource utilisation, and the adoption of distinctive practices, ACC has achieved faster project completion and prudent capital allocation, resulting in long-term value creation for all stakeholders.

Set Mind – Traditional

- Traditional Bookkeeping (Past)

- Control focused

- Cost Centre-based approach

- Restricted internal communication

- Working Capital Management

Mindset – Enterprise Value

- Growth-oriented (Future)

- Gatekeeper for Compliance

- Broader approach covering ESG

- Multi-stakeholder engagement

- Focus beyond Cash flow and Liquidity management

Changing Risk Profile

- Counterparty Risk

- Supply Chain Risk

- Intellectual Property Protection

- Data Security

- Growth – Organic / Inorganic

Internal Operating Challenges

- Cost Management & Forecasting

- Maintaining employee morale

- Attracting / retaining qualified employees

- IT Infrastructure and transformation

- Process and operations

Regulatory / Stakeholder Management

- Local Government Policy

- Increased regulatory and stakeholder expectations

- Financial Regulations

- Trade policies and agreements

Market and Competitive Pressures

- Consumer demand

- Financial / banking system

- Credit market / interest rates

- Currency volatility

- Price volatility

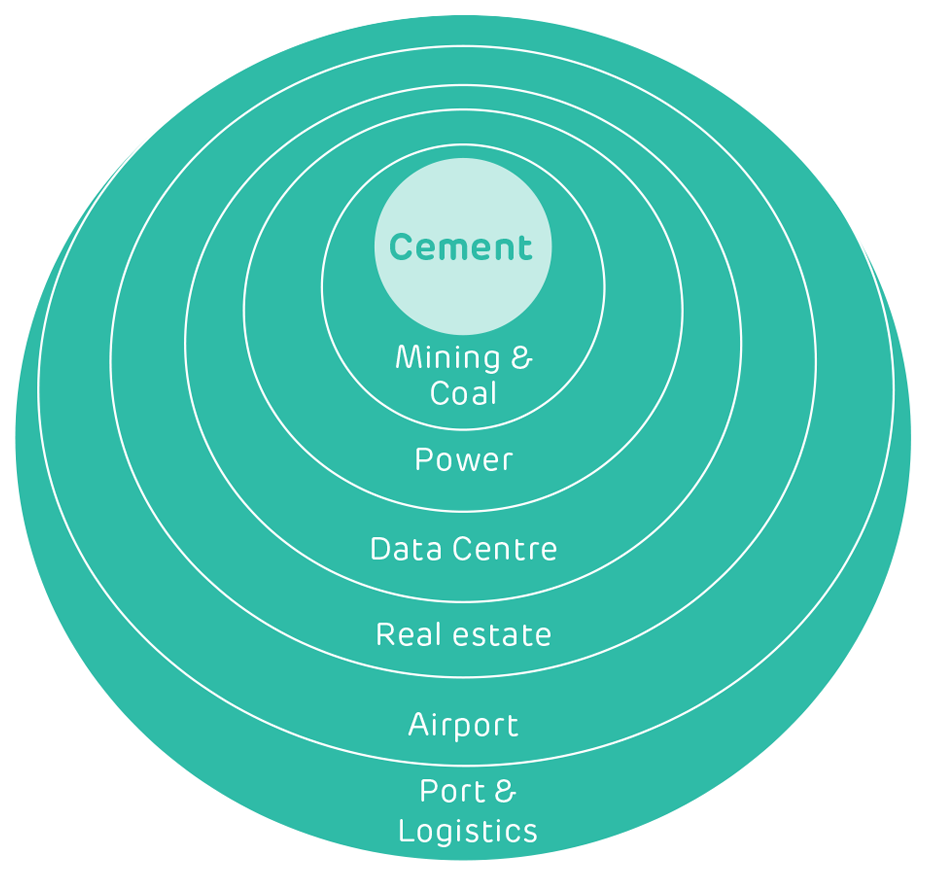

Leveraging Group Synergy

ACC is utilising various Group synergies to ensure financial prudence and profitability.

Intelligent PHYGITAL Infrastructure

Realty

Supply to upcoming projects – Dharavi, Navi Mumbai Airport, Ganga Expressway

Coal

Use AEL /ANR expertise in procuring coal and mining operations

Power & Renewables

Leverage Adani Power Ltd’s expertise to improve CPP’s operational

ABEX Services/ Digital Infra

Leverage shared services vertical of the Group, along with digital infra (IT)

Sportsline

Leveraging Adani Sportsline to showcase the Brand's value proposition

Logistics

Leverage APSEZ’s MMLPs to serve major demand centres and use the Company’s expertise in logistics to reduce cost

People

Talent movement within the Group across verticals

Fly Ash

Utilisation of fly ash generated from power plants

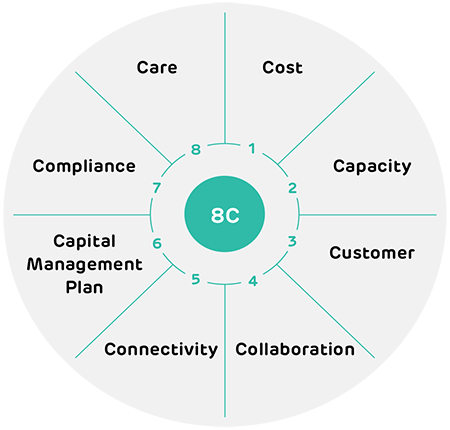

ConsistenC Model

The Company’s constant endeavour is to create long-term value and strengthen its financial position while continuing to build and nurture stakeholder relationships and trust. To achieve this, the Company has implemented the ConsistenC model, which includes:

Cost

Capex Initiative and leveraging group synergy for reduction and optimisation of production cost

Capacity

Double the capacity from 79 MTPA to 140 MTPA by FY 2027-28 through organic and inorganic route

Customer

Engagement with the dealers, sales promoters, CFAs and technical partners, to provide solutions, not just products

Collaboration

Collaboration with internal and external stakeholders

Connectivity

Drive enhanced Connectivity through digitisation initiatives

Capital Management Plan

Improving treasury return and working capital management; proper financing mix for the ongoing and future capex initiatives

Compliance

Cement Industry needs to comply with various regulations like mining, Factories Act, labour laws, environmental laws, SEBI (LODR) guidelines and Companies Act among others

Care

Empathy towards employees through employee engagement, training, and development plan, providing the right working environment

Mergers and Acquisitions (M&A) and Integration

ACC’s strategic M&A activities have significantly bolstered its market presence and spurred growth. The adept integration of acquired entities has been meticulously executed, ensuring seamless alignment with the Group’s vision and values, thus maximising synergies and delivering value to stakeholders. In the past year, its parent, Ambuja Cements Limited successfully integrated Sanghi Industries and Asian Concretes and Cements into its cement business. Further, Ambuja has completed the acquisition of 1.5 MTPA cement grinding unit in Tuticorin Tamil Nadu in April 2024.

Hedging

ACC employs robust hedging strategies to mitigate financial risks stemming from market fluctuations. These mechanisms effectively manage the Company’s exposure to volatile commodity prices, exchange rate fluctuations, and interest rate risks, thereby safeguarding financial performance and enhancing stability.

ESG Benefits in Financial Terms

The Company’s commitment to Environmental, Social, and Governance (ESG) principles goes beyond altruism, yielding tangible financial benefits. Prioritising sustainability initiatives enhances operational efficiency, reduces costs, accesses new markets, and strengthens stakeholder relationships, bolstering longterm financial resilience and value creation. Adequate capital expenditure is planned for sustainability initiatives, including the addition of renewable energy powers and waste heat recovery systems, among others.

Journey from Opex to Capex

ACC’s strategic shift from operating expenditure (Opex) to capital expenditure (Capex) underscores its focus on long-term value creation and sustainable growth. This transition allows the Company to invest in cutting-edge technologies, modernise infrastructure, and enhance operational efficiency, laying a solid foundation for future prosperity.

Financial Engineering

ACC optimises its capital structure through innovative financial engineering, maximising shareholder value and mitigating financial risks. The Company’s adept utilisation of financial instruments, capital markets, and structured transactions enables it to navigate complex financial landscapes, driving sustainable growth and enhancing resilience amidst market uncertainties.

![]() Case Study

Case Study

‘udAAAn’ a transformative journey aimed at propelling Adani Cements to new heights of success. This initiative encompasses a series of actions across various aspects of the Company’s operations, playing a crucial role in enhancing ACC’s key performance indicators (KPIs).