Adjusted EBITDA

APL

Note: Includes prior period items contributing ` 9,322 cr to EBITDA

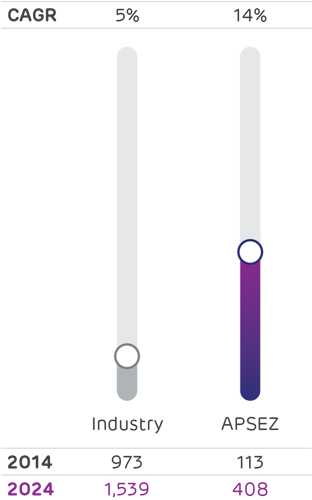

APSEZ

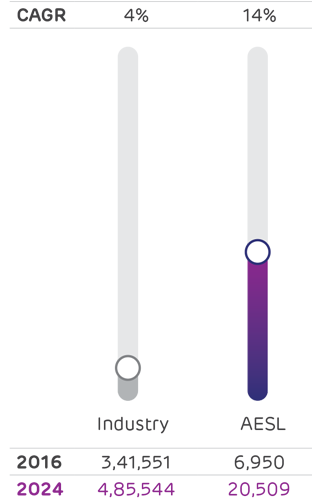

AESL

AEL

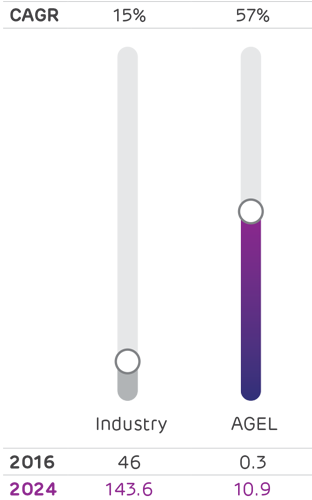

AGEL

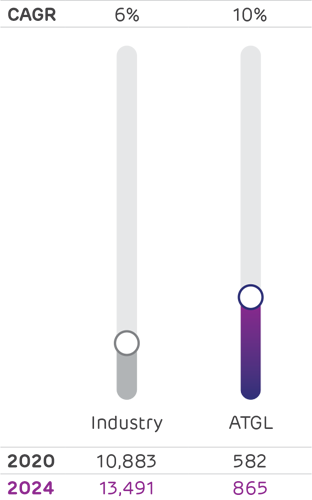

ATGL

APL

Ambuja Cements Limited

(with subsidiaries ACC Limited and Sanghi Industries Limited)

AWL

PAT

APL

APSEZ

Comparable PAT*

AESL

AEL

AGEL

ATGL

APL

Ambuja Cements Limited

(with subsidiaries ACC Limited and Sanghi Industries Limited)

AWL

*Comparable PAT excludes all one-time items like regulatory income, provisions, bilateral charges

Note 1: Growth pertains to growth in FY 2023-24 vs FY 2022-23

Note 2: Adjusted EBITDA: PAT incl. Share of Profit from JV + Current Tax + Deferred Tax +

Depreciation + Finance Cost + Unrealised Forex Loss / (Gain) + Exceptional Items

Note 3: EBITDA and PAT of AWL was impacted on account of hedges dis-alignment, tariff rate quota

disparity and losses in Bangladesh operations

Cargo Volume

Growth (MMT)

Renewable Capacity

Growth (GW)

Transmission Network

Growth (ckm)

City Gas Distribution

Volume (MMSCM)

Passenger Traffic

(Mn)

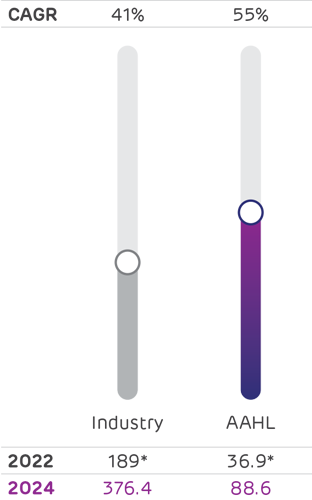

Note: The start year considered for industry data is the year when the business commenced.

* Pax numbers were impacted due to pandemic in FY 2021-22