The Indian economy has registered average growth rate of 6% for the decade ending in 2023-24, partly driven by the recovery after the pandemic and progressive economic reforms. This momentum is expected to continue, supported by favourable demographics, stable governance, robust urban and rural demand, technological advancements and substantial government investment in infrastructure. The cement industry has also benefitted from the conducive operating environment within the country.

Indian Cement Industry

Economic growth typically triggers a wave of development and urbanisation, as people's incomes rise, leading to improved living standards or migration to urban centres in search of better opportunities. It often leads to the construction of residential complexes, commercial establishments and infrastructure facilities, all of which require significant amounts of cement. As the pace of urbanisation accelerates, the demand for cement increases, prompting the industry to expand production capacities and innovate production methods.

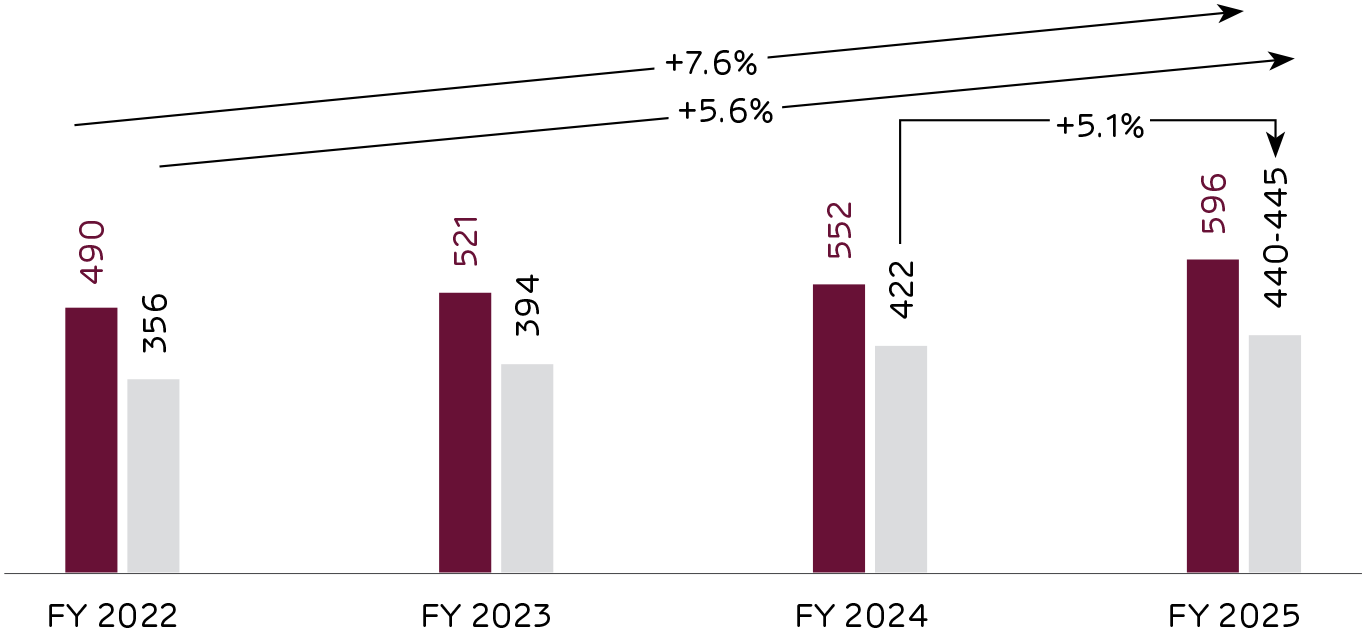

India, the world's second-largest cement producer, has a per capita consumption of just 250 kg — seven times lower than China’s 1,600 kg— highlighting vast growth potential. Driven by sustained demand from the housing and infrastructure sectors, cement volumes are projected to grow by 4-5% annually, reaching 440-445 million metric tonnes (MT) in FY 2024-25. This growth is expected to continue, with a further increase of 6-7% annually, to reach 475-480 million MT by FY 2025-26.1

Cement Producer in the world

Installed Capacity

The Indian cement industry is poised for significant growth, with installed capacity projected to reach 850 million tonnes per annum (t/a) by 2030 and 1,350 million t/a by 2050.2 Strong economic fundamentals, including robust GDP growth, India’s transition to a middle-income country, and an expanding working-age population, are expected to drive cement demand.

Additionally, recent income tax cuts and substantial capital expenditure plans are expected to further stimulate housing and infrastructure development. The Cement Manufacturers’ Association (CMA) of India has set a target for a CAGR of over 6% in installed capacity. With utilisation rates approaching 70%, capacity expansion will be a key focus for producers. As a result, mergers and acquisitions are likely to remain a major trend in the industry.

Forecasted CAGR of installed cement capacity by CMA

Continued Expansion

of the Indian Economy

India's economy has demonstrated remarkable resilience and dynamism in recent years, positioning itself as one of the world's largest and fastest-growing economies. Looking ahead to the FY 2025-26, the economy is projected to expand by 6.5%, driven by robust domestic demand, strategic government initiatives, technological advancements and a favourable global economic environment.3

Forecasted GDP Growth of Indian economy in FY 2025-26

Infrastructure Push

The Union Budget for FY 2025-26 has allocated capital expenditure (capex) of ` 11.21 lakhs crore, a 10% increase over the revised estimate of ` 10.18 lakhs crore (USD 116.78 billion) for FY 2024-25. The budget focused on infrastructure investment to drive economic growth, stimulate demand, and improve productivity across key sectors. Additionally, Public Private Partnerships (PPPs) are being actively encouraged to enhance execution and boost private sector participation in infrastructure development.

Allocated Capital Expenditure for FY 2025-26

Growth of Housing Sector

The aspiration for home ownership, especially in the post pandemic period is fuelling the growth of India’s housing sector, across urban and rural areas. As the primary consumer of cement, the housing sector currently accounts for around 65% of the nation’s cement demand. Housing, therefore, continues to remain one of the major demand drivers for the cement sector.

of India’s Cement Demand comes from the Housing Sector

Projected GDP

Growth

(%)

Demand and Supply Trend

Suppy Demand

Growth Drivers and Trends

Population

Growth

With a population of nearly 1.5 billion, India has become one of the world’s most populous nations, creating a steady and substantial demand for housing. A significant portion of this population belongs to the working-age group, further adding impetus to the real estate sector and driving its growth potential.

Urbanisation and Infrastructure Development

Rapid urbanisation and government initiatives like Smart Cities Mission, PMAY and AMRUT has resulted in the development of residential, commercial and infrastructure projects, which have substantially increased cement consumption.

Rural Development

Investments

Government projects for rural roads, schools, healthcare and sanitation facilities have expanded cement demand in rural areas, creating new market opportunities.

Technological Advancements and Innovation

Advanced manufacturing technologies improve efficiency, reduce costs and enhance product quality. While innovations in the form of green cement, ready-mix concrete and specialty cement help to adopt sustainable practices, it also helps to fulfil evolving construction requirements.

Industry

Consolidation

Mergers and Acquisitions (~200 MT capacity in 10 years) have enhanced the operational capacity of existing players, optimised production and helped to achieve economies of scale.

Environmental

Sustainability

Strict environmental regulations are compelling manufacturers to adopt cleaner and sustainable practices which help to reduce their carbon footprint and retain their competitive edge.

ACC’s Positioning

With rising government initiatives, cement demand is set to grow 1.2–1.5 times GDP. ACC aims to surpass this, targeting double the industry growth rate. The Company continues to support the nation’s growth vision by continuously investing in organic and inorganic growth strategies. The Company is also embracing digitalisation to optimise operations and boost profitability. As awareness about the ecological impact of grows, ACC is significantly expanding its capacity for alternative energy production to minimise the use of finite resources.

With India poised to become a USD 25 trillion economy by 2050, ACC is determined to capitalise on emerging opportunities. The Company has significantly expanded its production capacity and intends to steer its growth path with an emphasis on innovation, operational excellence and value creation.

1ICRA

2IBEF

3Annual Economic Survey