Strength

is what we strive for

Resilience

defines us

With a deep sense of responsibility and a commitment to sustained development, we have built a core infrastructure platform – one that grows alongside India and contributes meaningfully to its progress. Our approach sets new industry benchmarks through scale, strategic capital deployment, innovative project development, and rapid execution.

Read More

the Chairman

We have become – more formidable, more unbreakable, more stronger and more resilient!

GAUTAM ADANI

CHAIRMAN, ADANI GROUP

Record of Growth

Cement Sales Volume

(MnT)Cement Production Volume

(MMT)*The Company had changed its financial year ending from December 31 to March 31. FY 2022-23 was for 15 months (January 01, 2022 - March 31, 2023). Therefore, the data for FY 2023-24 and FY 2024-25 is not comparable with the figures for the 15 months year ended March 31, 2023

of Innovation

ACC Limited (ACC) is a part of the Adani Group, one of the largest and fastest-growing portfolios of diversified sustainable businesses. The Company is a prominent player in the Indian cement, concrete, and building materials sector, with a vast manufacturing and marketing presence across the country.

Read moreDevelopment

Circular Economy

of Waste-derived Resources Used

Renewable and

Green Energy

CSR Spent

CSR Beneficiaries

till FY 2024-25

Local Sourcing of Raw Material

from Within India

Training Hours

Training Hours per Employee

Channel Partners

Data Security

complaints

Corporate Responsibility Committee

Dedicated committee consisting of Independent Directors to oversee sustainability and climate change strategy, initiatives and performance

Independent Directors

100%

Board Committees chaired by Independent Directors

‘Good’ Rating

in Indian Corporate Governance Scorecard (2023) by IIAS

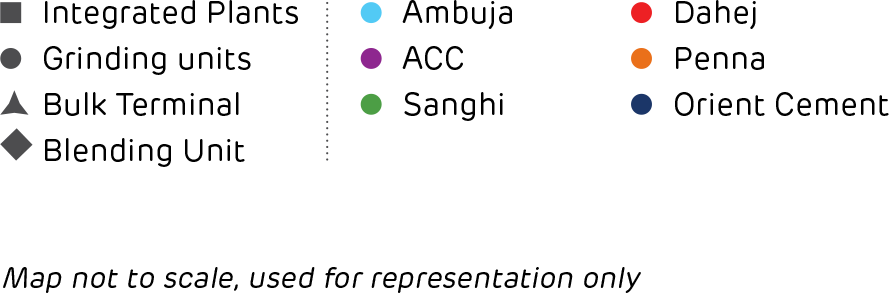

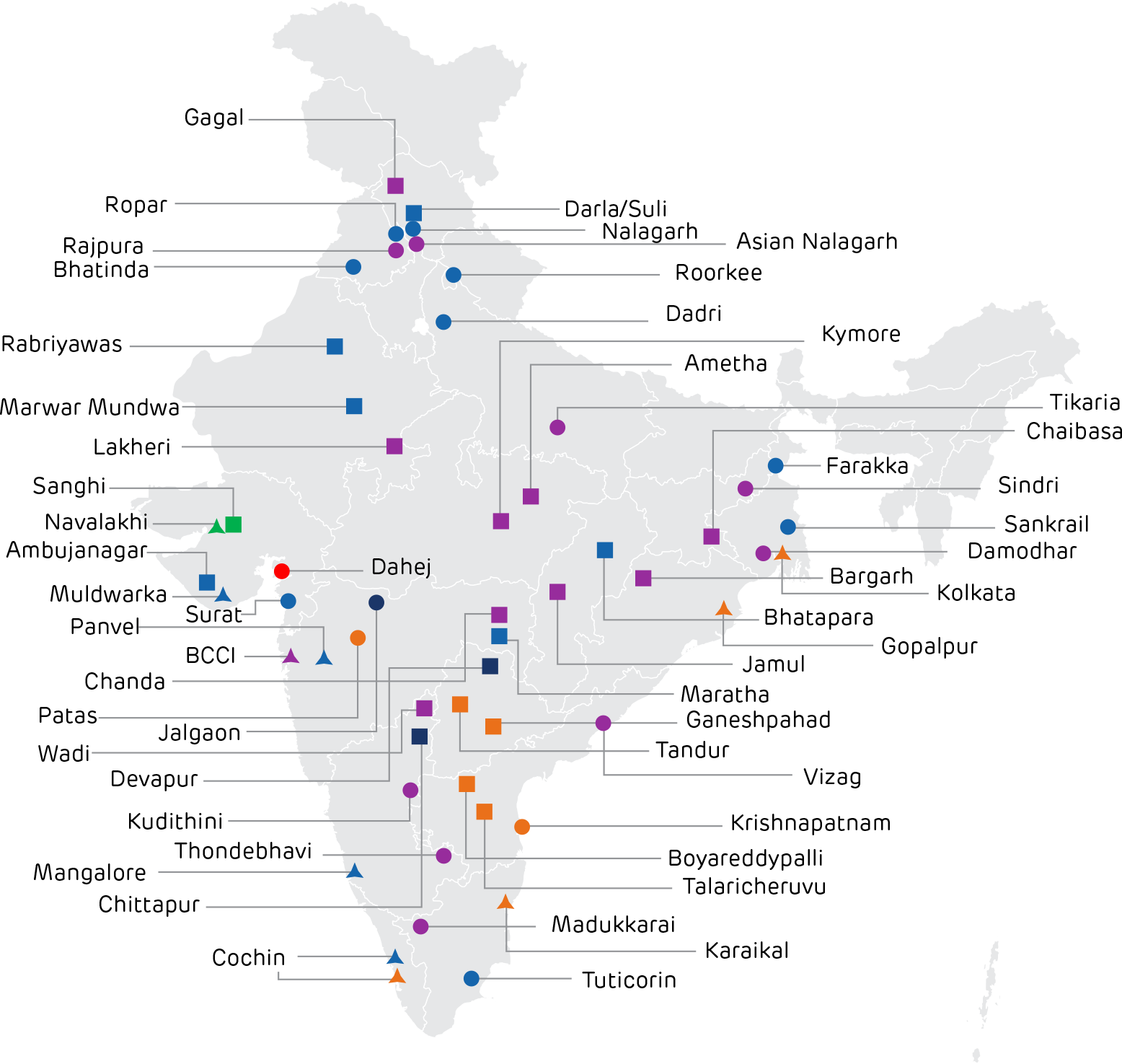

States and UTs across 635+ Districts

Map not to scale, used for representation only

*The Company had a cement capacity of 88.9 MTPA during the reporting period. The successful completion of acquisition of Orient Cement during April 2025 has subsequently added 8.5 MTPA cement capacity. This along with the operationalisation of 2.4 MTPA capacity expansion at Farakka as well as 0.5 MTPA capacity addition through de-bottlenecking at various plants has taken the Company’s total capacity to 100.3 MTPA.

Performance