ACC has leveraged its operational excellence and cost efficiencies to deliver resilient financial performance during the year gone by. With expanded EBITDA margins, higher premium product sales, a robust ground network and best-in-class working capital of 35 days, ACC has achieved the highest ever sales volume in a year, continues to remain debt-free and maintains ample cash and cash equivalents to fund growth plans.

Focus Areas

| Growth | Margin Management and Efficiency | Financial Stability | Shareholder Returns |

|---|---|---|---|

|

Development and Key Initiatives

|

|

|

|

|

Key Performance Indicators

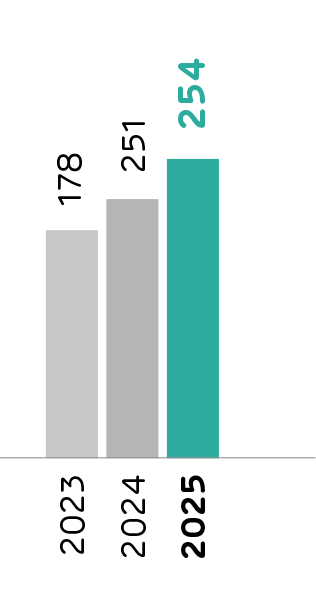

` 21,762 crore

Revenue from Operations

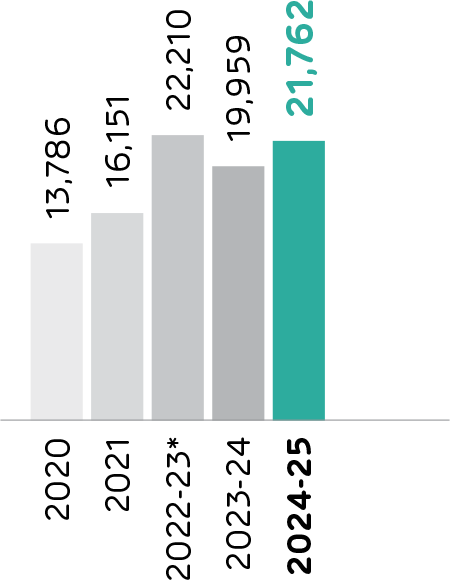

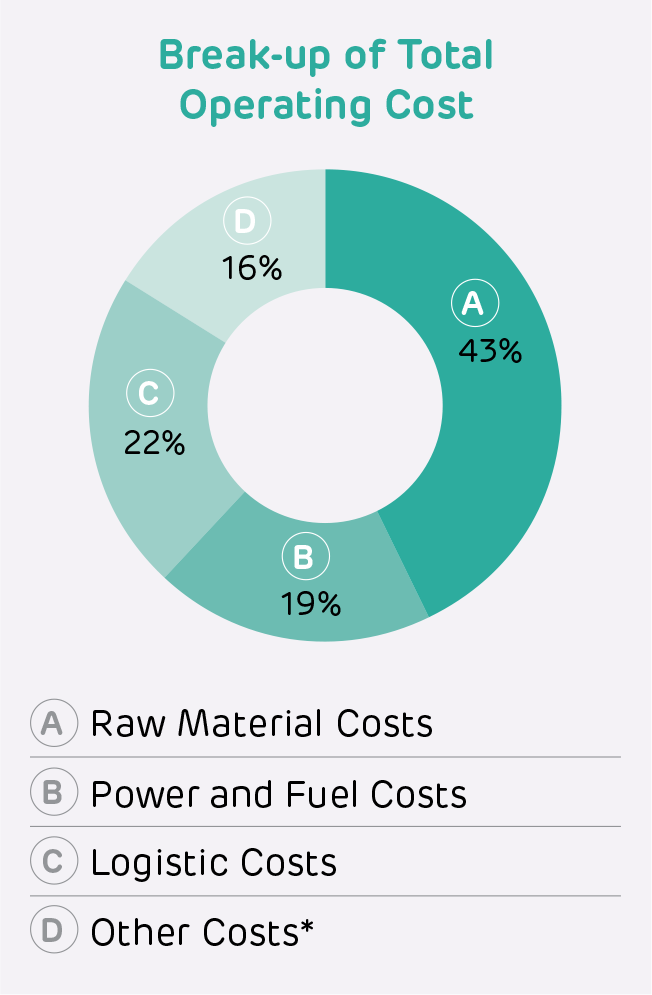

39 MnT

Cement Sales Volume |

18%

EBITDA Margin |

`3,593

Cash and Cash Equivalents

` 25,413 crore

Total Asset Base

` 18,271 crore

Net Worth |

` 7.5

Proposed Dividend per Share in FY 2024-25

` 141 crore

Dividend Payout during the Year

6%

Dividend Payout Ratio |

Material Topics

- 1 Economic Performance

- 2 Procurement Practices

- 3 Climate and Energy

- 4 Indirect Economic Impacts

Stakeholders Impacted

-

Investors and Shareholders

Investors and Shareholders

-

Employees

Employees

-

Channel Partners

Channel Partners

-

Suppliers

Suppliers

-

Community and NGOs

Community and NGOs

UN SDGs Impacted

Overview

ACC leveraged its parent’s market expansion, operational excellence, cost efficiency and strategic synergies to report resilient financial performance during the year. Targeted market initiatives and enhanced consumer engagement have led to notable volume growth. By optimising costs through group synergies and business excellence initiatives, the Company’s net worth has reached an all-time high of ` 18,271 crore. The Company has reduced operating expenses, increased sale of blended, premium and value-added products, and expanded EBITDA margins in alignment with its ambition to become the lowest cost cement producer in the world. ACC continues to utilise its financial expertise, cash reserves and internal accruals to fuel expansion plans and strengthen its growth trajectory.

Growth Trajectory

The active engagement of the Technical Support team with key influencers has strengthened the ground network and substantially increased trade sales volumes. By offering value-added solutions and implementing focused branding strategies, the Company is successfully expanding the share of premium products. These initiatives are collectively contributing to higher volume growth and enhancing the Company’s revenue generation capacity.

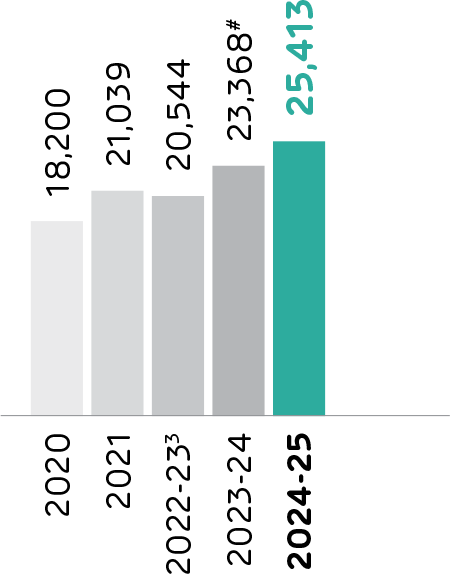

Revenues from Operations

(` crore)

Cement Sales Volume

(MnT)

9The Company had changed its financial year ending from December 31 to March 31. FY 2022-23 was for 15 months (January 01, 2022 - March 31, 2023). Therefore, the data for FY 2023-24 and FY 2024-25 is not comparable with the figures for the 15 months year ended March 31, 2023

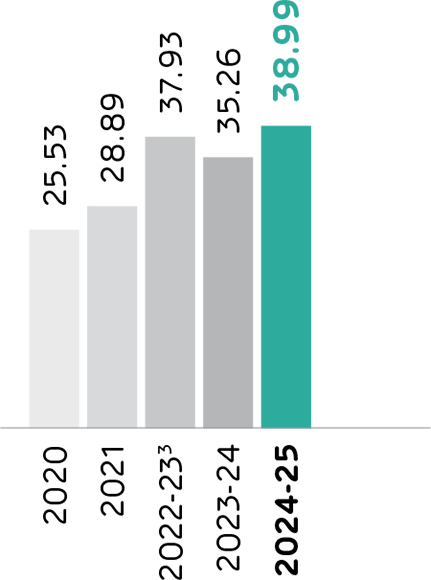

Delivering Results Consistently

The Company is consistently enhancing efficiencies to significantly reduce costs to ` 3,650 per MT by FY 2027-28. Leveraging 65% cost synergies with Adani Group’s market leadership in power, coal and ports, the Company benefits from economies of scale, efficient logistics and a reliable raw material supply. The Company’s parent company – Ambuja Cements Limited has an accelerated Capex programme, funded through internal accruals, further supported by these growth synergies. Increased trade sales, premium product volumes and value-added solutions, coupled with cost reduction and efficiency improvements, have bolstered margins and delivered robust volume growth at a price premium.

ACC is harnessing digitalisation, automation, AI and lead distance reduction to drive logistics cost efficiencies. With a growing presence along India’s coastline, ACC’s parent Ambuja Cements operates 17 sea-based terminals and Grinding Units, including 11 strategically located Bulk Cement Terminals (BCTs). Specialised BCFC rakes and EV trucks enhance volume handling while further reducing costs. Additionally, with 40% of its Fly-ash requirements secured under long-term agreements, ACC ensures raw material security and retains cost leadership in the market.

*Other Costs include: Other expenses; Employee benefits expenses; Changes in inventories of finished goods, work-inprogress, and stock-in-trade.

Earnings

Reduction in several expenses such as power, fuel, freight, etc. have led to an improvement in profitability from ` 2,335 crore# in FY 2023-24 to ` 2,402 crore in FY 2024-25. Other expenses have been reduced primarily because of the implementation of a unified business model with a new, leaner structure, alongside automation and digitisation initiatives that have simplified processes. Additionally, synergies with the Group Company have led to better-negotiated rates wherever possible.

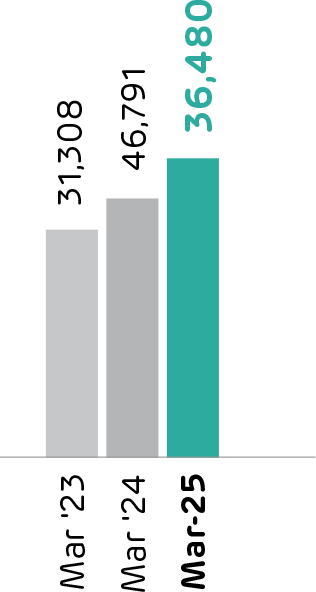

Assets

With ACC’s parent company - Ambuja Cements Limited’s recent acquisition of Orient Cement Limited (OCL) and Penna Cement Industries Limited (PCIL), along with multiple projects nearing completion, ACC's parent company - Ambuja Cements Limited's operational capacity has surpassed 100 MTPA in April 2025. Further, 1.3 Bn MT limestone reserves were secured in FY'25, bringing total reserves to ~9 Bn MT. Additionally, OCL’s high-quality limestone reserves are expected to act as a key enabler in achieving the targeted 140 MTPA capacity by FY 2027-28.

Growing Asset Base

(` in crore)

3The Company had changed its financial year ending from December 31 to March 31. FY 2022-23 was for 15 months (January 01, 2022 - March 31, 2023). Therefore, the data for FY 2023-24 and FY 2024-25 is not comparable with the figures for the 15 months year ended March 31, 2023

#Restated - refer note 63 (D) of Consolidated Financial Statement

Credit Rating

CRISIL Ratings has reaffirmed its 'CRISIL AAA/Stable/CRISIL A1+' ratings on ACC Ltd.'s bank facilities and short-term debt programme, reflecting its strong business risk profile. The Company benefits from the Adani Group’s leadership in coal, power and logistics, which significantly drives cost efficiencies. Additionally, ACC remains debt-free despite substantial payouts for acquisitions during the year, demonstrating its financial strength and operational efficiency.

Long-Term Credit Rating

Short-Term Credit Rating

Focused Expansion

ACC along with its parent company Ambuja Cements Limited is undertaking multiple capacity expansion projects, both organic and inorganic, towards its target of achieving 140 MTPA of cement manufacturing capacity by FY 2027-28. ACC has prudently allocated capital to expand capacities at Sindri, Salai Banwa and Kalamboli.

ACC is expected to benefit from Ambuja Cement’s expansion in Bihar. Ambuja Cements Limited is also setting up a 6 MTPA cement grinding unit in Bihar, at an investment of I 1,600 crore. The project will be executed in three phases, with the first phase of 2.4 MTPA, targeted for commissioning by Q4 FY 2025-26.

Adani Cement's Targeted Capacity

(MTPA)

Capacity Details (MTPA)

| Existing Capacity | 38.55 |

| Projects under Execution | 5 |

| Total Capacity by FY 2025-26 | 43.55 |

Sustainable Investment Strategy

In the past year, ACC has strengthened its commitment to sustainability through strategic investments designed to reduce environmental impact and promote eco-conscious practices. By focusing on energy efficiency and increasing the use of renewable energy, the Company is positioning itself for lower power costs in the future, aligning with its goal of enhancing green energy usage across all operations. Over I 75.5 crore has been spent to advance sustainability initiatives during the year.

Additionally, ACC has stepped up its waste management efforts, embracing circular economy principles to decrease reliance on virgin material and reduce waste. This not only minimises environmental impact but also enhances margins. These efforts are integral to ACC’s ambitious target of achieving Net Zero emissions by 2050. Notably, ACC is the only large Indian cement company committed to achieving Net Zero by 2050 with targets validated by the Science Based Targets initiative (SBTi), solidifying its leadership in sustainable practices.

Spent to Inculcate Sustainable Practices in FY 2024-25

Investor Relations

The Company recognises the significance of its investors as essential providers of financial capital, which is crucial for fuelling growth and achieving long-term success. To maintain a strong relationship with investors, the Company engages with them through a variety of platforms. These include Annual General Meetings (AGM), quarterly and annual results presentations and meetings with Chief Investment Officers (CIOs) and High Net-Worth Individuals (HNIs).

Furthermore, the Company participates in investor conferences both domestically and overseas, organises investor roadshows, events, plant visits and presents detailed investor reports. These modes of interaction are conducted quarterly, annually or as required, ensuring that stakeholders are kept informed of the Company's progress and outlook.

Investor relations (IR) at ACC plays a strategic role in conveying the investment proposition to institutional investors and shareholders. Key business updates were proactively shared across the year through various channels such as emails, social media platforms, one-on-one calls and stock exchange disclosures. The Company engaged with over 300 investors and research professionals across different geographies through investor conferences, one-on-one meetings and non-deal roadshows.

Investors have key expectations regarding the Company's performance, including sustainable growth, attractive returns and profitability. Additionally, they emphasise the importance of risk management, corporate governance and clear policies. Investors also seek better disclosures, transparency and credibility in the Company's financial reporting.

Highly Reputed and Independent Research Houses Providing Active Coverage

Healthy Blend of Domestic and Foreign Institutional Investors

In response, the Company provides regular financial disclosures and governance updates. The Company also prioritises effective risk management, maintains an open line of communication through its Investor Relations function, and ensures timely and transparent communications with all stakeholders to address their expectations and foster long-term trust.

Domestic and Overseas Institutional Investors and Research Analysts Engaged in Active Interaction

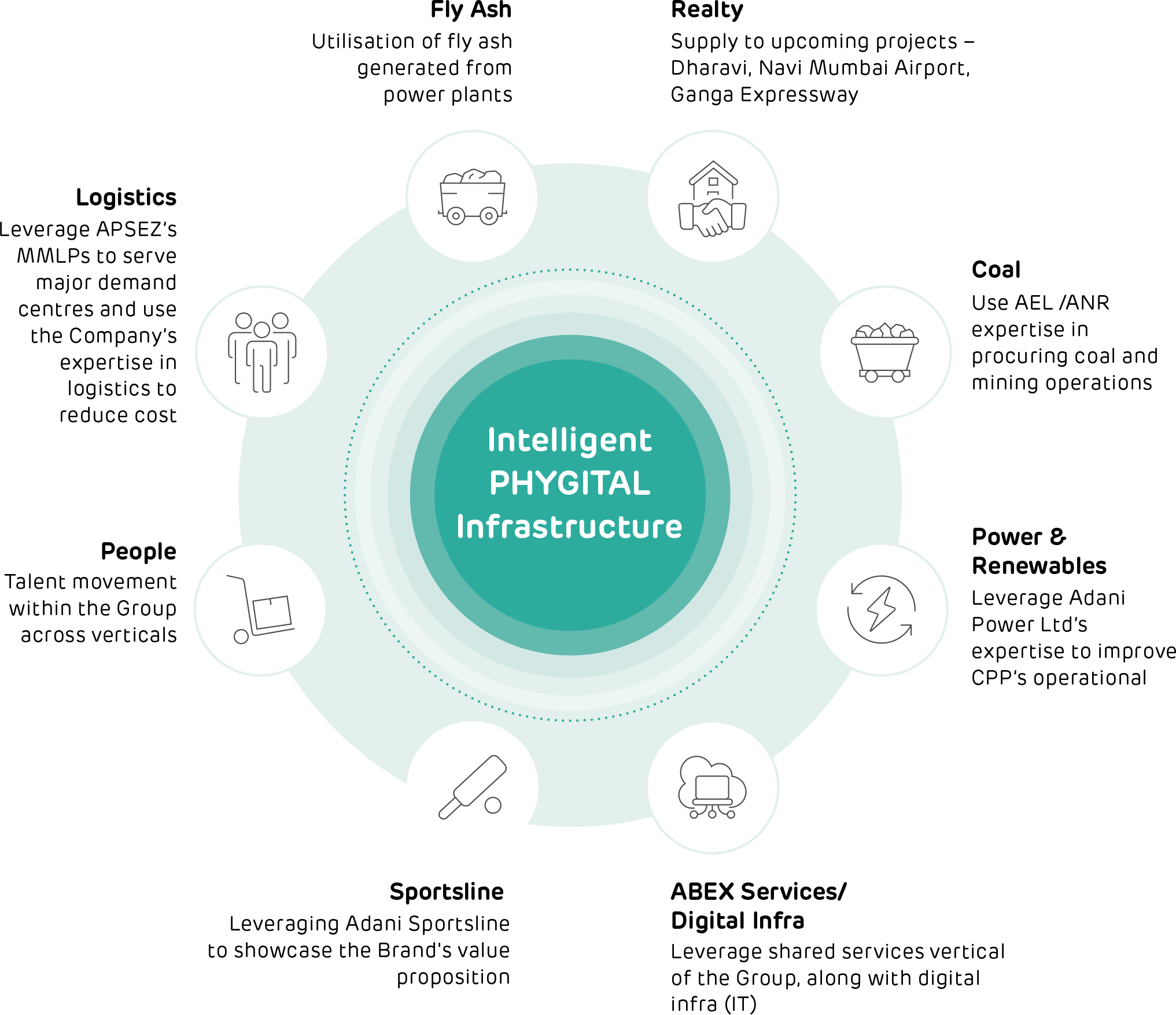

Leveraging Group Synergy

ACC harnesses the collective strength of the Adani Group, aligning its strategic initiatives with the Group’s extensive capabilities. By leveraging shared resources, cutting-edge technologies, and financial expertise, the Company enhances operational efficiency and accelerates sustainable growth. This synergy drives cost optimisation, strengthens supply chain and logistics and unlocks innovative digital solutions, reinforcing ACC’s competitive edge in the market.

Merger and Acquisitions (M&A) and Integration

The Company aims to become the lowest-cost cement producer along with its parent company - Ambuja Cements Limited, while ensuring the delivery of quality products to the market. Strategic acquisitions of Ambuja Cement have expanded the Company’s capacity and strengthened its competitive edge. By integrating these assets, ACC has optimised the supply chain, reduced costs and enhanced market presence. Post the integration of ACC and Ambuja Cements Limited to the Adani Portfolio, 33 MTPA capacity has been added. The acquisitions by ACC and its parent company Ambuja Cements, made at a capex of I 24,896 crore, include the integration of Orient Cement, Penna Cement, Sanghi Industries, Asian Concretes & Cements, Asian Fine Cements and a Grinding Unit in Tuticorin.

ACC's parent company – Ambuja Cement’s strategic acquisitions have strengthened its capacity and market footprint, provided a competitive edge while optimising the supply chain, reducing costs and enhancing market presence. With a series of Capex and Opex initiatives in place, the Company continues to accelerate its cost leadership journey, reinforcing its position as an industry leader.

Worth of acquisitions made by ACC and its parent company Ambuja Cements

Benefitting from Ambuja's Strategic Expansions

ACC stands to gain from the ongoing expansions of its parent company, Ambuja Cements Limited, which continues to strengthen its market position through strategic acquisitions. A key milestone in this journey is the acquisition of Orient Cement Ltd. (OCL) for an equity value of I 8,100 crore — an ambitious step towards surpassing 100 MTPA operational capacity in April 2025. This includes a 46.6% stake in OCL, acquired from its promoters and select public shareholders, fully funded through internal accruals. The acquisition unlocks significant clinker capacity in North India, capitalising on OCL’s premium limestone reserves in Rajasthan.

These additions bring highly efficient assets into the portfolio, including railway sidings, captive power plants, renewable energy infrastructure, waste heat recovery systems (WHRS), and alternative fuels and raw materials (AFR) capabilities. By integrating these strengths, Adani Cement is poised to reinforce its industry leadership. ACC is also expected to benefit significantly from these developments, driving operational efficiency and long-term growth.

Hedging

ACC employs robust hedging strategies to manage financial risks arising from market fluctuations. These measures effectively mitigate exposure to volatile commodity prices, exchange rate variations and interest rate changes, ensuring financial stability and safeguarding performance.

Financial Engineering

ACC strategically optimises its capital structure through innovative financial engineering to maximise shareholder value and mitigate risks. By leveraging financial instruments, capital markets and structured transactions, the Company adeptly navigates complex financial landscapes, ensuring sustainable growth and enhancing its resilience against market uncertainties.

Tax Transparency

ACC has established a dedicated tax governance framework to manage its tax affairs ethically and responsibly. This framework ensures timely compliance with tax obligations, fostering stakeholder trust and safeguarding the Company’s reputation. A specialised team, led by subject matter experts, follows international best practices through standard operating procedures to ensure consistency and transparency across all operations.

The Legal, Regulatory, and Tax Committee at the Board level oversees the effectiveness of our tax compliance programme, while the Board of Directors acts as the ultimate authority on tax matters, reinforcing our commitment to ethical, compliant and professional tax practices.

Enterprise Value Creation

ACC has redefined its approach, from a traditional financial perspective to a dynamic business finance model, that prioritises long-term value creation and meaningful business partnerships. With a steadfast commitment to delivering exceptional stakeholder value, the Company has embraced a disciplined financial strategy that ensures optimal resource utilisation and prudent capital allocation. By adopting innovative practices and streamlining project execution, ACC has achieved faster project completions while laying a strong foundation for sustainable growth and enduring stakeholder success.

Enterprise Value Framework

- Growth-oriented (Future)

- Gatekeeper for Compliance

- Broader approach covering ESG

- Multi-stakeholder engagement

- Focus beyond Cash Flow and Liquidity Management

Economic Value Created

(C in crore)

| FY 2024-25 | FY 2023-24 | |

|---|---|---|

| Direct Economic Value Generated | 22,835 | 20,452 |

| Revenue from Operations | 21,762 | 19,959 |

| Other Income | 1,072 | 493 |

| Economic Value Distributed | 21,402 | 19,152 |

| Cost of goods sold8 | 12,511 | 10,885 |

| Employee Benefit Expenses | 718 | 737 |

| Payments to Providers of Capital | 141 | 174 |

| Payments to Government | 7,989 | 7,319 |

| Community Investments | 43 | 37 |

| Economic Value Retained | 1,433 | 1,300 |

8Cost of Goods sold includes: - (i) Cost of material consumed, (ii) Purchase of stock-in-trade, (iii) Changes in inventories of finished goods, work-in-progress and stock-in-trade, (iv) Power and fuel, (v) Consumption of stores and spares, and (vi) Consumption of packing material

Market Capitalisation

ACC (Standalone)

BSE 100 Ranking Company