The Adani Portfolio of Companies embodies a bold vision and enduring impact. With strength as our foundation and resilience as a force, we build businesses that sustain the nation’s growth and drive sustainable progress. We scale with purpose, navigate challenges with conviction, and lead with responsibility. We are catalysts shaping a future‑ready India for generations to come.

Profile

Headquartered in Ahmedabad, India, the Adani portfolio of companies was founded and promoted in 1988 by visionary industrialist Mr. Gautam Adani. Starting with the commodity trading business under the flagship Adani Enterprises Limited (formerly Adani Exports Limited), the Adani portfolio of companies today ranks among India’s largest and most dynamic business conglomerates.

What Makes the Adani Portfolio of Companies Unique?

- Market-leading position and bold investments in sectors critical to the Indian economy including four key areas – transport and logistics, energy and utility, materials and metals, and various B2C sectors

- Global credibility with four of the eleven publicly-traded companies being investment grade (IG)-rated and having a reputation as India’s only Infrastructure Investment Grade bond issuer

Vision

To be a world-class leader in businesses that enrich lives and contribute to nations in building infrastructure through sustainable value creation.

Values

Courage: We shall embrace new

ideas and businesses

Trust: We shall believe in our

employees and other stakeholders

Commitment: We shall stand by

our promises and adhere to high

standards of business

Culture

Passion: Performing with

enthusiasm and energy

Results: Consistently achieving

goals

Integration: Working across

functions and businesses to

create synergies

Dedication: Working with

commitment in the pursuit of

our aims

Entrepreneurship: Seizing new

opportunities with initiatives

and ownership

- ESG commitments in line with industry best practices and credible global and national ESG frameworks; overseen by a 100% independent Board-level ESG committee - Corporate Responsibility Committee (CRC)

- The Adani Foundation has empowered over 9.1 million lives with impactful health, nutrition, education, basic sanitation, women’s livelihood and skills development efforts aligned with the aspirations of new India.

- The Adani Portfolio plays a pivotal role in advancing India's

decarbonisation goals. The Group has pledged to invest USD 100 billion

over the next decade to support the green transition. Significant strides

have been made by the companies within the portfolio to accelerate their

decarbonisation efforts, with the aim of achieving Net Zero emissions by

2070 or earlier, in alignment with India's Net Zero ambitions.

- To reduce Scope 1 emissions, the Adani Portfolio is enhancing operational efficiency, electrifying operations wherever possible, adopting biofuels, and piloting hydrogen fuel cells where other options are not feasible.

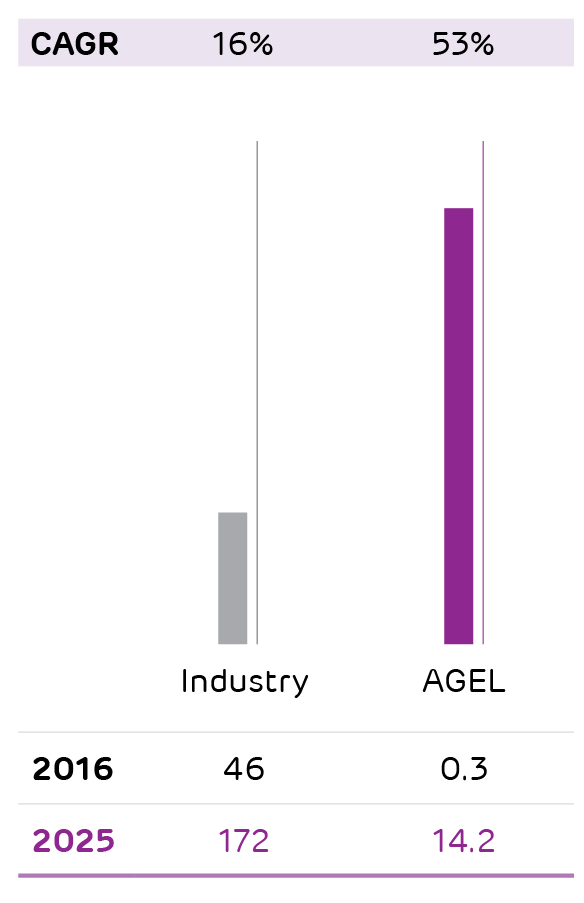

- The Portfolio's significant renewable capacity, currently at 14.2 GW and projected to reach 50 GW by 2030, helps reduce Scope 2 emissions by sourcing green electricity.

- The Portfolio of Companies are also exploring waste heat recovery and energy storage solutions, including utility-scale batteries and green hydrogen for continuous green electricity.

- To abate Scope 3 emissions, Adani Portfolio businesses are adopting circular economy measures and exploring options to incentivise upstream and downstream stakeholders to reduce their emissions by offering price premiums for low-carbon products and services.

- The pathway for decarbonising the last mile focusses on the creation of an integrated green hydrogen ecosystem, the adoption of sustainable energy storage solutions, the exploration of carbon capture and utilisation (CCU) opportunities, the establishment of a carbon pricing mechanism, and the implementation of pilot projects aimed at reducing hard-to-abate greenhouse gas emissions.

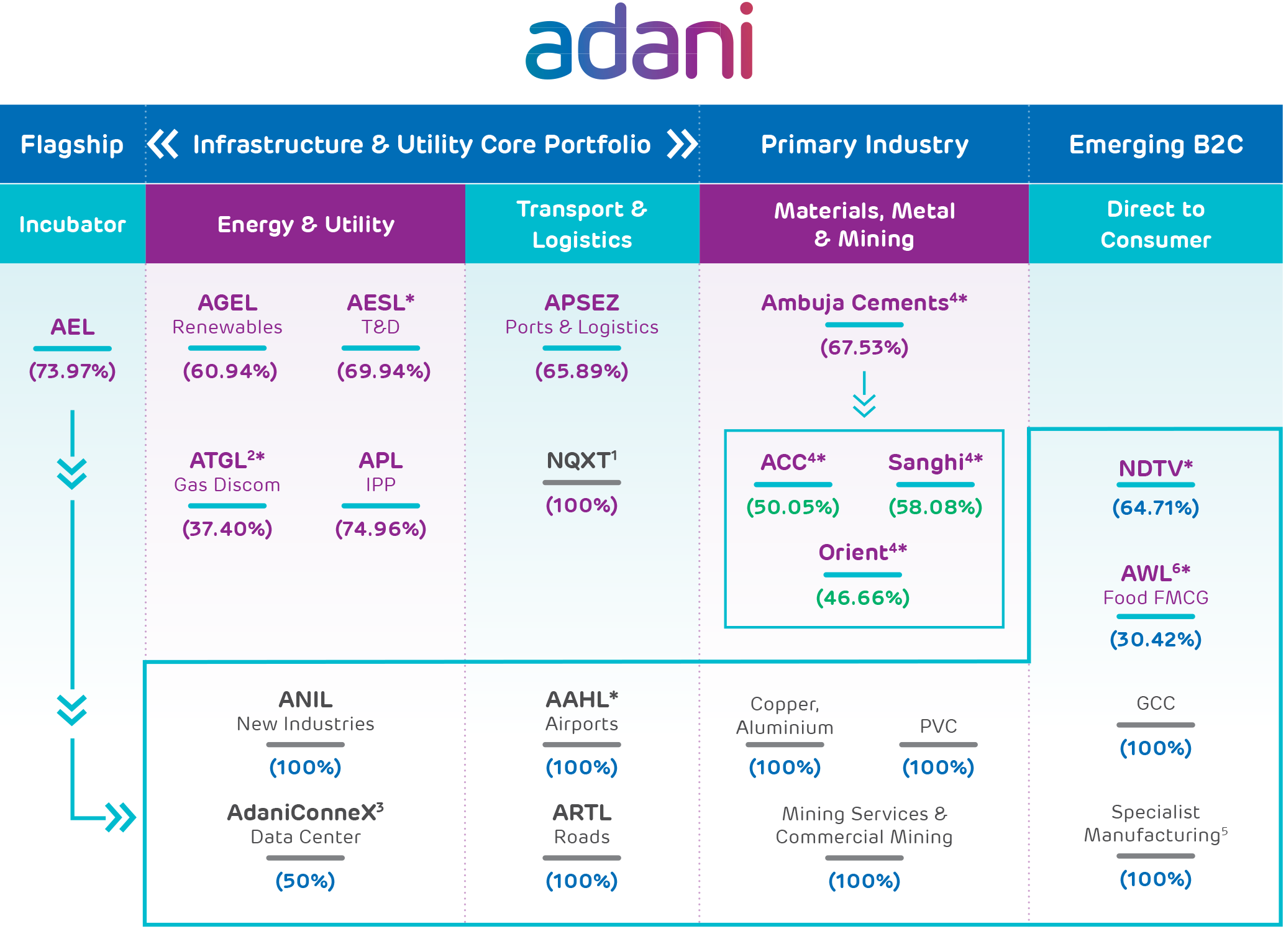

Designed for Growth, Nation-Building and Value Creation

The Adani portfolio of companies is a world-class infrastructure and utility portfolio with a presence spanning India’s critical sectors. With a market leadership position across the businesses and through bold investments, innovation and sustainability efforts, the portfolio of companies is positioned for growth and shaping the nation’s progress.

- Listed entity

- Unlisted entity

- *Direct Consumer

% Adani family equity stake in Adani Portfolio companies

% AEL equity stake in its components

% Ambuja equity stake in its subsidiaries

- NQXT: North Queensland Export Terminal. On April 17, 2025, APSEZ Board has approved the acquisition of NQXT by APSEZ

- ATGL: Adani Total Gas Limited, JV with Total Energies

- Data center, JV with EdgeConnex

- Cement includes 67.53% (67.57% on Voting Rights basis) stake in Ambuja Cements Limited as on March 31, 2025 which in turn owns 50.05% in ACC Limited. Adani directly owns 6.64% stake in ACC Limited. Ambuja Cements Limited holds 46.66% stake in Orient Cement Limited w.e.f April 22, 2025.

- Includes the manufacturing of Defence and Aerospace Equipment

- AWL Agri Business Limited: AEL to exit Wilmar JV, diluted 13.51% through Offer For Sale (January 13, 2025), residual stake dilution is pursuant to agreement between Adani & Wilmar Group. | Promoter’s holdings are as on March 31, 2025.

The Adani portfolio of companies does not just represent diversification, they are market leaders in their respective industries. With extensive operations across India and dominance in key sectors, these businesses are integral to India’s economic progress, making them assets of national importance. Through pioneering sustainability efforts and investments, they continue to champion national progress while building a sustainable future.

ADANI

ENTERPRISES

LIMITED

India’s largest business incubator

cell and module

manufacturing capacity

Lane-KM

road projects

data center tied-up

capacity

airports network

WTG manufacturing

capacity

Commitment to Sustainable Progress

| Net zero commitment |

Tax transparency audit |

Renewable Energy |

Waste managed through Recycle and Reuse |

|---|---|---|---|

| ✓2070 or earlier | ✓ | 24% of electricity mix | 99% |

Commitment to the Nation’s Progress

Capex in FY 2024-25 in utility and infrastructure-focussed segments including next-generation businesses

Why it matters?

Contribution to the nation’s self-reliance and growth alongside addressing the logistics and energy transition challenges

ADANI PORTS AND SPECIAL ECONOMIC ZONE LIMITED

India's largest Integrated Transport Utility

of India’s total cargo share

cargo handling capacity

marine fleet

Operating in MEASA* waters *Middle East, Africa, South Asia

MMLPs, warehouses, agri-silos, rakes and trucks

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓2040 | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

Capex in FY 2024-25 towards expanding ports, railways, roadways, multi-modal logistics parks, warehouses, grain silos, marine flotillas and SEZ infrastructure.

Why it matters?

To create one of the world’s largest Integrated Transport Utility companies with an extensive network that enables efficient, cost-effective movement of goods, boosting the competitiveness of Indian industries.

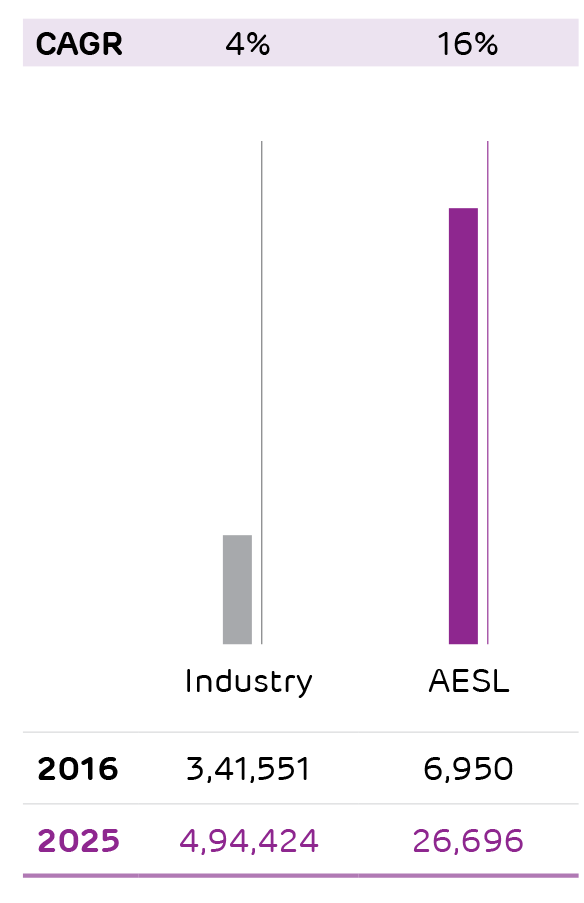

ADANI ENERGY SOLUTIONS LIMITED

India’s largest private-sector transmission and distribution company

transmission network

smart metering portfolio

power distribution customers

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓2050 | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

As India's leading integrated energy solutions provider with interests in:

- Transmission: Majority RE evacuation projects

- Distribution: Becoming a supplier of choice and increasing RE share

- Smart metering: Advancing grid modernisation and RE integration

- Cooling Solutions: Pioneering efficient cooling solutions

Why it matters?

Address Indian energy market evolution including energy transition and grid modernisation alongside meeting growing demand.

ADANI GREEN ENERGY LIMITED

One of the world’s largest and fastest growing RE companies

India's largest RE portfolio

Developing world’s largest RE plant at Khavda in Gujarat

Targeted Operational Capacity by 2030, on a secured growth path backed by resource-rich sites. Represents 10% of India’s non-fossil fuel capacity target

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓2050 | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

Of fully secured RE capacity creation target, including at least 5 GW of energy storage by 2030

Why it matters?

To support India’s net zero by 2070 ambition through accelerated RE capacity creation with the lowest-cost green electron.

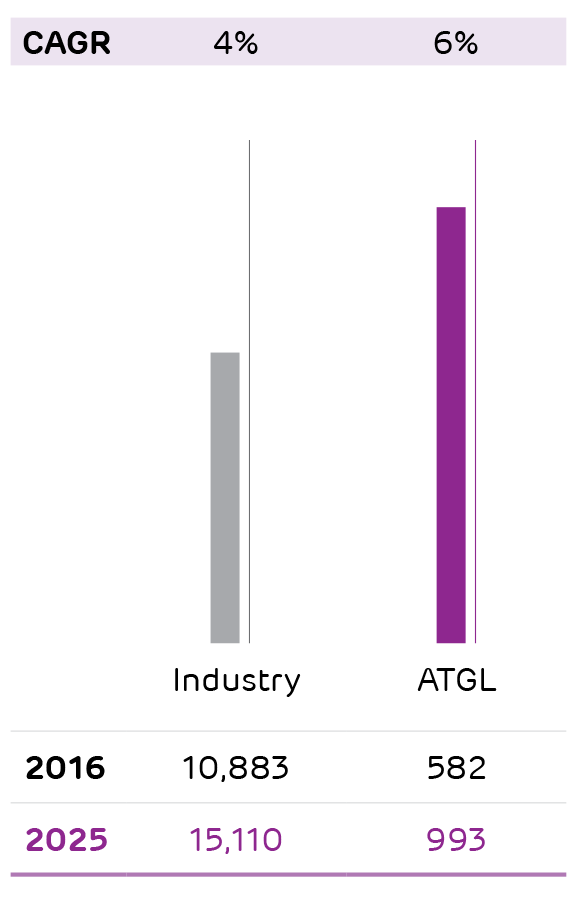

ADANI TOTAL GAS LIMITED

India’s largest city gas distributor

geographical areas of gas supplies

addressable population

Districts

installed EV charging points

in Uttar Pradesh, India

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓2070 | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

Secured for network development:

- PNG pipelines for homes, industries and commerce

- CNG and LNG stations for transport consumers

Why it matters?

To lead India's energy transition (of decarbonisation and net zero) by delivering affordable, reliable low-carbon energy solutions across sectors.

* Including JV, IOAGPL

AMBUJA CEMENTS LIMITED*

India’s second-largest cement manufacturer

cement brands

cement manufacturing capacity

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓2050 | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

Cement projects underway, aiming

for 140 MTPA capacity by 2028

Why it matters?

To address India’s rising cement demand, driven by infrastructure projects and rising housing and commercial needs.

*The Company had a cement capacity of 88.9 MTPA during the reporting period. The successful completion of acquisition of Orient Cement during April 2025 has subsequently added 8.5 MTPA cement capacity. This along with the operationalisation of 2.4 MTPA capacity expansion at Farakka as well as 0.5 MTPA capacity addition through de-bottlenecking at various plants has taken the Company’s total capacity to 100.3 MTPA.

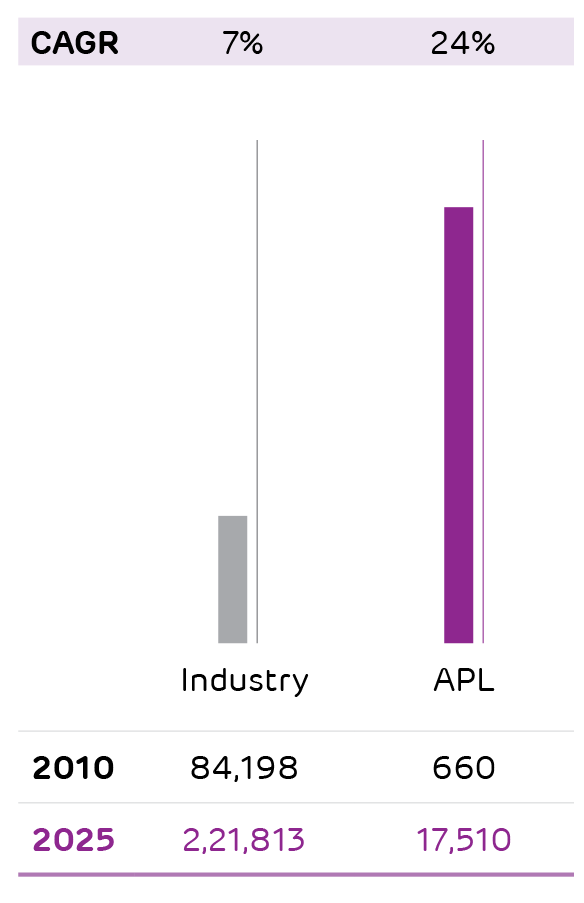

ADANI POWER

LIMITED

India’s largest

private-sector thermal

power producer

single-location private thermal IPP (Mundra)

operational capacity

Commitment to Sustainable Progress

| SBTi/Net zero commitment | Tax transparency audit | UNGC participant | IBBI |

|---|---|---|---|

| ✓ | ✓ | ✓ | ✓ |

Commitment to the Nation’s Progress

Additional capacity creation by 2030

Why it matters?

Ensuring reliable energy for India’s dynamic economy with peak power demand estimated to grow from 250 GW in May 2024 to nearly 400 GW by 2031-32, which will necessitate more than 80 GW of additional thermal power capacity.

AWL AGRI

BUSINESS

LIMITED

India’s largest edible oil brand and a leading packaged foods player

port-based edible oil refinery

MTPD

edible oil refinery capacity

million

retail outlets/ households reach

Commitment to the Nation’s Progress

- AWL has a capacity of over 5.5 Million MT (MMT), which is ~25% of India Edible Oil consumption.

- One of the very few Food & FMCG players to invest in large manufacturing capacities, ensuring consistent supply of high quality, hygienic packaged foods

- Commitment of setting up world-class manufacturing facilities

Why it matters?

Meeting the rising demand for healthy, safe and high-quality food for a healthy growing nation.

NDTV

LIMITED

Among India’s most trusted media companies

NDTV 24x7: 65 countries;

NDTV India: 10 countries; and

NDTV Profit: 5 countries.

Combined presence across

all social media platforms

Commitment to the Nation’s Progress

With a commitment to unbiased, in-depth

reporting, NDTV brings stories that truly matter,

ensuring integrity and accuracy remain at the

heart of our journalism.

From cutting-edge analysis to on-ground

reporting, NDTV’s coverage has resonated deeply

with viewers across the nation. This commitment

was reflected in our impactful storytelling around

major events such as the World Economic Forum

2025 at Davos, Lok Sabha Elections, Mahakumbh,

and State Elections.

Why it matters?

NDTV is a significant player in Indian media due to its long-standing reputation for credible, independent, and fearless journalism. Its commitment to unbiased reporting and high editorial standards makes it a trusted news source in an era of misinformation.

Impacted by Adani’s core infra platform

Investment in green energy transition by 2030

Asset base ensuring resilient critical infrastructure and best-in-class performance across its life cycle

crore

Total global tax and other contributions

crore

towards CSR for FY 2024-25

crore

Market

capitalisation

Consolidated FY 2024-25 Revenue

|

APL 58,906 |

APSEZ 32,383 |

AESL 24,447^ |

AEL 1,00,365 |

|

AGEL 12,422 |

ATGL 5,442 |

Ambuja Cements 37,699 |

Consolidated FY 2024-25 Adjusted EBITDA

|

APL 23,917 |

APSEZ 20,471 |

AESL 7,746 |

AEL 17,315 |

|

AGEL 10,532 |

ATGL 1,179 |

Ambuja Cements 8,645 |

Consolidated FY 2024-25 PAT

|

APL 12,750 |

APSEZ 11,061 |

AESL 922# |

AEL 8,018* |

|

AGEL 2,002 |

ATGL 654 |

Ambuja Cements 5,158 |

Please Note: Revenue and Adjusted EBITDA includes Other Income.

^ Includes SCA income of ` 5,064 crore in FY 2024-25

#AESL PAT is after an exceptional item of ` 1,506 crore due to carve-out of

the Dahanu power plant.

*Due to recognition of gain consequent to OFS of stake in AWL Agri Business

Limited (formerly known as Adani Wilmar Limited)

PAT - Profit after tax including profit/loss from JV | EBITDA: Earning before Interest,

Tax Depreciation & Amortisation |

Adjusted EBITDA: PAT + Share of profit from JV & Associates + Current Tax + Deferred Tax

+ Depreciation & Amortisation +

Finance Cost + Unrealised Forex Loss / (Gain) + Exceptional Items

Accelerating India’s Rise with Industry-Best Performance

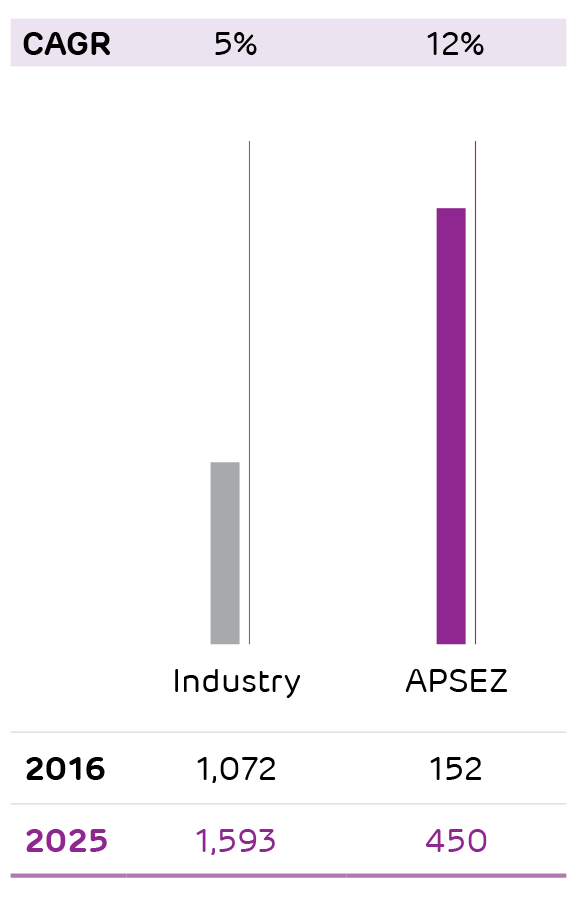

Cargo Volume Growth

(MMT)

Renewable Capacity Growth

(GW)

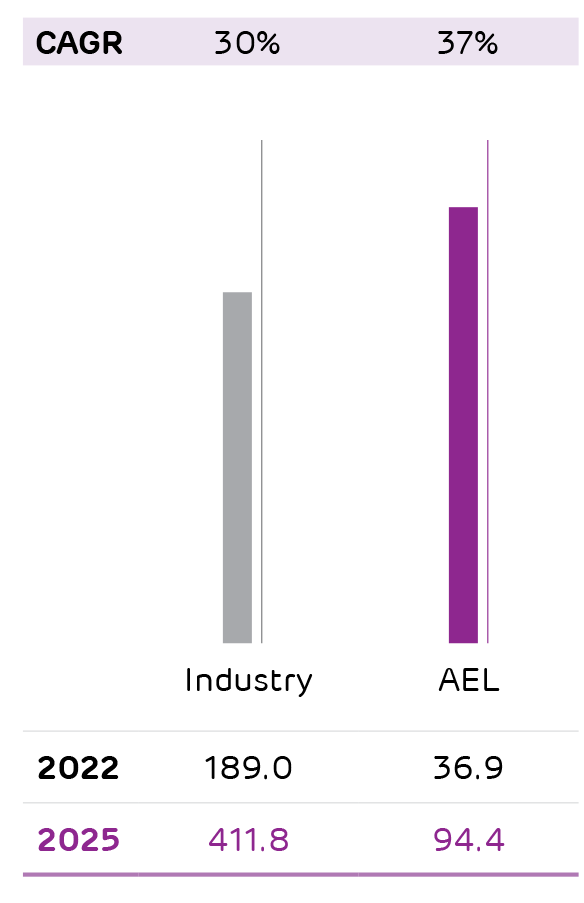

Transmission Network Growth

(ckm)

City Gas Distribution Volume

(MMSCM)

Thermal Power Capacity

Growth (MW)

Airports Passenger Traffic

Growth (million)